Corporate Tax Accountant Resume Samples

4.9

(110 votes) for

Corporate Tax Accountant Resume Samples

The Guide To Resume Tailoring

Guide the recruiter to the conclusion that you are the best candidate for the corporate tax accountant job. It’s actually very simple. Tailor your resume by picking relevant responsibilities from the examples below and then add your accomplishments. This way, you can position yourself in the best way to get hired.

Craft your perfect resume by picking job responsibilities written by professional recruiters

Pick from the thousands of curated job responsibilities used by the leading companies

Tailor your resume & cover letter with wording that best fits for each job you apply

Resume Builder

Create a Resume in Minutes with Professional Resume Templates

CHOOSE THE BEST TEMPLATE

- Choose from 15 Leading Templates. No need to think about design details.

USE PRE-WRITTEN BULLET POINTS

- Select from thousands of pre-written bullet points.

SAVE YOUR DOCUMENTS IN PDF FILES

- Instantly download in PDF format or share a custom link.

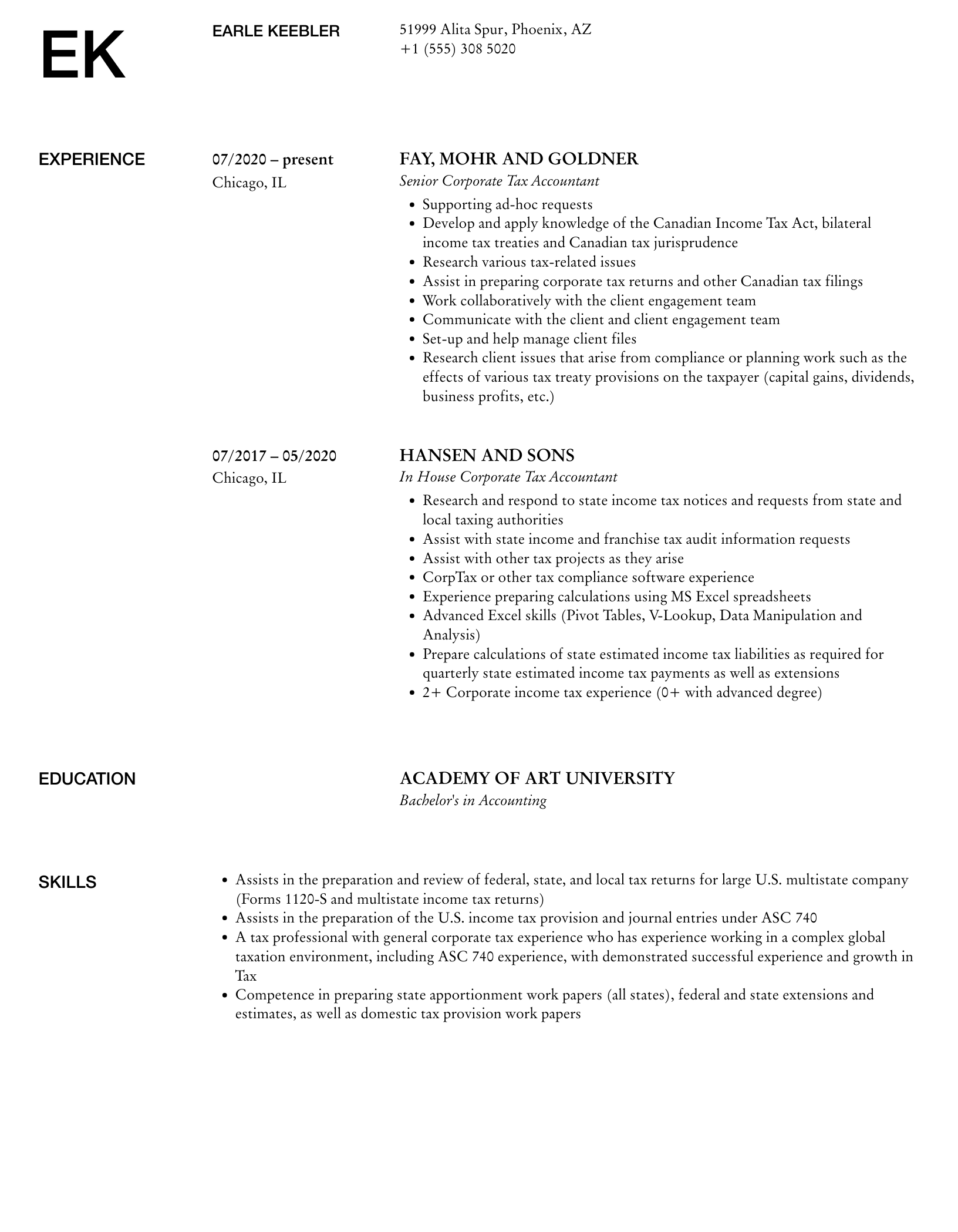

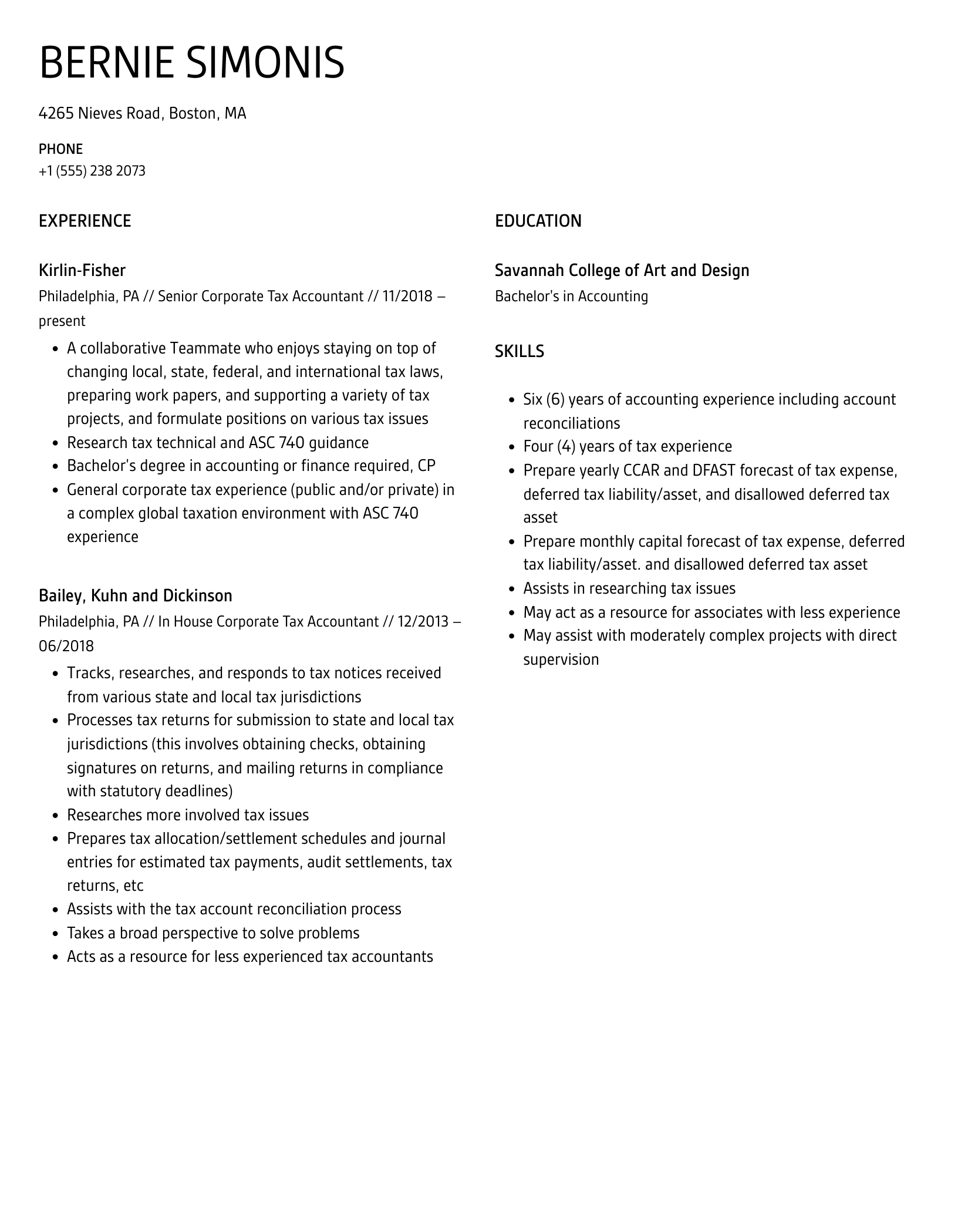

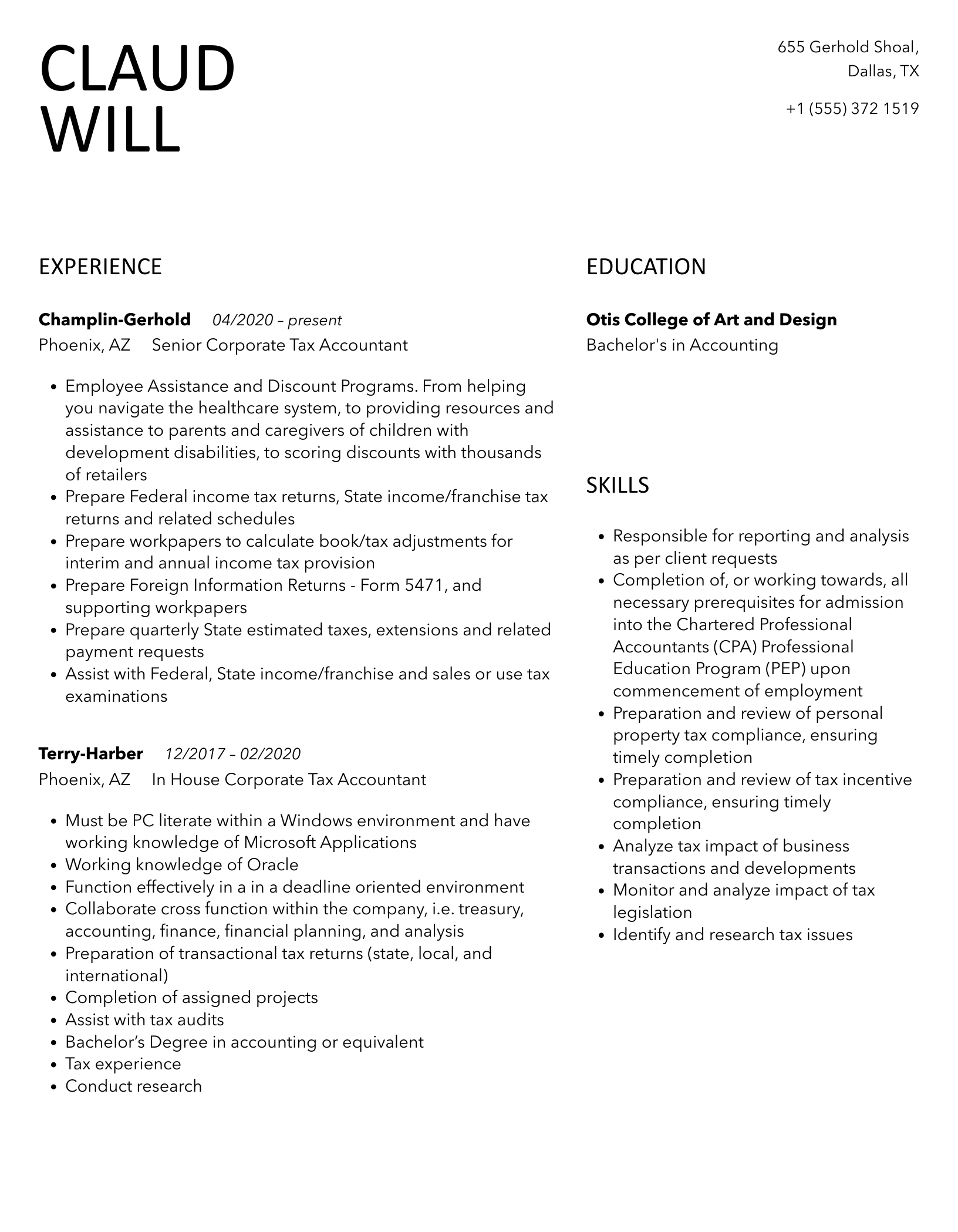

RS

R Schoen

Royal

Schoen

2917 Hettinger Alley

Boston

MA

+1 (555) 754 1440

2917 Hettinger Alley

Boston

MA

Phone

p

+1 (555) 754 1440

Experience

Experience

Detroit, MI

Corporate Tax Accountant

Detroit, MI

Hilll, Hammes and McGlynn

Detroit, MI

Corporate Tax Accountant

- Support tax projects including providing information to outside service providers

- Assist with development of transfer pricing positions and documentation

- Perform tax research and assist with tax planning initiatives

- Assist in combining pass-through investment activity

- Ensures improvements to compliance and provision processes

- Prepares work papers, calculations and forms with respect to US tax compliance

- Assisting with income tax provisions and quarter end close process

New York, NY

In House Corporate Tax Accountant

New York, NY

Cassin, Grant and Sauer

New York, NY

In House Corporate Tax Accountant

- Supporting the Group Tax manager on other tax queries

- Production of statutory tax filings & quarterly reporting to Group

- Responding to all corporate tax queries

- Increasing tax awareness in the group

- Ensure the Group is compliant with Sarbanes Oxley

- Corporate tax compliance

- Periodic review of compliance and reporting processes and controls, with a view to continuous improvement. Assist with SAO/SOX sign-off process

present

Boston, MA

Senior Corporate Tax Accountant

Boston, MA

Rath-Oberbrunner

present

Boston, MA

Senior Corporate Tax Accountant

present

- Interacts with key client management to gather information, resolve tax-related problems, and makes recommendations for business and process improvements

- Performs other duties as requested

- Assist with tax diligence on future acquisition scenarios

- Assisting with state and federal IRS audits

- Perform limited research and draft technical memoranda

- Execute assigned client tax engagements from start to finish, which includes

- Prepares and/or reviews local, state, and federal tax returns and quarterly tax provisions, as well as financial and management reports

Education

Education

Bachelor’s Degree in Accounting

Bachelor’s Degree in Accounting

Ohio University

Bachelor’s Degree in Accounting

Skills

Skills

- Professional in approach and dedicated to high standards, with excellent attention to detail and right first time mentality

- Ability to complete assigned tasks within the designated timeframe with good attention to detail

- Good communication skills with ability to work as a team

- Detail-oriented, organized and capable of prioritizing workload to complete multiple tasks and meet aggressive deadlines

- Strong attention to detail

- Good attention to detail

- Basic J-GAAP and thorough tax knowledge

- Highly detail oriented with exceptional follow-up and sense of urgency

- Qualified/ Part qualified tax professional (CTA / ATT) or relevant HMRC background, with strong tax technical experience

- Excellent teamwork skills with proven ability to work effectively in a variety of situations

11 Corporate Tax Accountant resume templates

Read our complete resume writing guides

1

Corporate Tax Accountant Resume Examples & Samples

- Reviews federal and state income tax returns

- Responds to notices from state and local jurisdictions

- Analyzes FASB 109 and FIN 48 regulations

- Prepares work papers, calculations and forms with respect to US tax compliance

- Makes preparation of audit and dispute resolution

- Analyzes and reconciles tax accounts and identifies potential unusual transactions or irregularities

- Handles various levels of tax consulting work in response to client needs

- Tax accounting and reporting concepts, practices and procedures

- FASB 109 and FIN 48 regulations and IRS filing requirements

- Utilization of the ProSystem Tax Software

- Tax compliance, audit management and planning

- Identify and resolve tax issues

- Communicate effectively, both orally and in writing, with all organizational levels

- Establish and maintain effective working relationships

- Bachelor's Degree in Accounting or Finance and a minimum of three (3) years experience in tax accounting at a public accounting firm

2

Corporate Tax Accountant Resume Examples & Samples

- Exposure to tax filing compliance and related concepts

- Exposure to calculations and concepts necessary to prepare domestic tax filing obligations

- Experience in performing tax research using various tools

3

Corporate Tax Accountant Resume Examples & Samples

- Prepare GAAP tax provisions for growing portfolio of 15-30 subsidiary investments including real estate, agriculture and natural resources

- Prepare corporate and partnership tax returns for investment portfolio

- Research tax accounting positions and draft written conclusions

- Research tax matters and prepare responses to taxing authorities

- Reconciliations of tax accounts

- Prepare state apportionment data

- Liaises with other associates in corporate tax department to leverage from their tax experience and company knowledge

- Fast paced delivery of time sensitive projects

- CPA is preferred but if not, working towards CPA

- Bachelor’s or Master’s degree in Accounting or Finance required

4

Corporate Tax Accountant Resume Examples & Samples

- At least 3 years of tax compliance experience

- Willingness to learn about tax withholding

- Ability to work independently and proactively as well as part of a team

- Ability to work 20-25 hours per week

5

Senior Corporate Tax Accountant Resume Examples & Samples

- Execute assigned client tax engagements from start to finish, which includes

- 3+ years of current tax compliance and/or tax consulting experience is required

- Public accounting firm or a large professional services organization is a preferred

- Proficiency in US GAAP, tax compliance, consolidated, corporate tax returns, consolidated federal tax returns, partnership and/or joint venture tax returns and combined state tax returns

- Ability to supervise other tax staff and lead assigned client tax projects

- Strong computer skills including proficiency in Microsoft Office Suite, Fast-Tax software and CCH is highly desirable

6

Corporate Tax Accountant Resume Examples & Samples

- 3+ years of tax accounting experience with at least 1 year in public accounting. Bachelor's degree required, preferably in accounting, or a tax concentration within an accounting program. CPA preferred. Must be detail oriented

- Create tax data collection systems

- Update the company sales tax database as tax rates change

- Research and correct process errors that caused incorrect tax filings

- Research the basis for tax positions to be taken

- Prepare and update tax provision schedules

- Advise management on the impact of new laws on tax liabilities

- Coordinate outsourced tax preparation work

- General ledger accounting and analysis responsibilities

7

In House Corporate Tax Accountant Resume Examples & Samples

- Corporate tax compliance

- Production of statutory tax filings & quarterly reporting to Group

- Ensure the Group is compliant with Sarbanes Oxley

- Supporting the Group Tax manager on other tax queries

- Increasing tax awareness in the group

- Responding to all corporate tax queries

8

Corporate Tax Accountant Resume Examples & Samples

- Work on tax provisioning under US GAAP

- Preparation of state income taxes and responding to notices

- Reconciliation of global tax accounts

- Work with outside tax firm on any tax related issues and audits

- Ad hoc projects as required

- 1 to 3 years of tax experience, either public accounting or corporate

- Prior experience working with one of the top tax softwares

9

Corporate Tax Accountant Resume Examples & Samples

- Assuring the company is in compliance

- Assisting with property taxes

- Utility taxes

- CAM

- Understanding of tax law, federal and state income tax concepts as well as GAAP accounting rules

- Ability to handle multiple priorities

10

Corporate Tax Accountant Resume Examples & Samples

- Solid Corporate Tax background

- Previous experience with Consolidated Revisions

- Working knowledge of Corporate Tax System (One Source System)

11

Corporate Tax Accountant Resume Examples & Samples

- Researches tax ramifications of moderately complex transactions

- Prepares work papers, calculations and forms with respect to Federal and state tax compliance

- Reviews Federal and state income tax returns, including consolidated/combined returns

- Supervises, reviews and analyzes state apportionment and allocation work papers

- Assists in preparation of foreign information returns (Forms 5471) and calculation of Subpart F income and Foreign Tax Credits

- Assists with audit requests and coordinates with federal and state auditors regarding moderate to complex tax issues

- Has regular contact with internal and external clients and/or auditors

- Reviews sales/use tax returns and other returns where necessary

- Leads projects of significant scope and complexity

- FASB 109 (ASC 740) and FIN 48 (ASC 740-10) regulations

- Federal and state tax return filing requirements and methodologies

- Utilization of the OneSource Tax Software

- Researching and interpreting Federal and state tax requirements

- Preparing for and supervising Federal and state income and sales tax audits

- Minimum of four (4) years’ experience in tax accounting at a public accounting firm

12

Corporate Tax Accountant Resume Examples & Samples

- Statutory reporting and tax accounting for life insurance companies

- Accruals of TIAA level and subsidiary taxes

- Liaise with internal and external tax professionals regarding reporting matters

- Liaise with asset managers and legal department to deliver reports, obtain data, and analyze operational changes

- Experience with Life Insurance Company taxation and Statutory Accounting (SSAP101) is preferred

- Excellent research, documentation, and communication skills

- Experience with Thompson Reuters OneSource Income Tax and Tax Provision software a plus

13

Corporate Tax Accountant Resume Examples & Samples

- Operations involve facets of private equity investment reporting and compliance

- Multi-tier ownership and holding structures

- ©2015 Teachers Insurance and Annuity Association of America-College Retirement Equities Fund (TIAA-CREF), 730 Third Avenue, New York, NY 10017 C23921

14

Corporate Tax Accountant Resume Examples & Samples

- Assist in preparing federal, state and international compliance tax items

- Assist in preparation of the tax provision, including pulling together supporting information

- Reconcile and maintain tax accounts

- Support tax projects including providing information to outside service providers

- Research complex tax matters and formulate opinions on the results of findings

- Minimum of 2 years of tax experience, including exposure to ASC740 and an understanding of the tax rules and regulations

- Collaborative, team player who seeks out development areas to continue to improve skills and increase knowledge

15

Corporate Tax Accountant Resume Examples & Samples

- Preparation of tax returns including corporate, enterprise, office premise, consumption, depreciable asset tax returns

- Monthly tax accrual in line with both the Japanese tax law and deferred tax assets calculation under J-GAAP

- Preparation of US tax data, in accordance to perspective from the US tax law

- Coordination of various types of tax audits

- Tax planning for other Tokyo branches

- Maintain good communication with financial regulators such as FSA, NTA, TRTB, and NTO

- Work as a team with the Global tax team members

- Personnel with more than 5 years experience in tax related field strongly encouraged to apply

- Certified tax accountants are strongly preferred

- Basic J-GAAP and thorough tax knowledge

- Business English and Japanese skills

- Good communication skills with ability to work as a team

- Be able to adapt to changes in regulations and business requirements

16

Senior Corporate Tax Accountant Resume Examples & Samples

- Minimum of 2-3 years federal income tax preparation experience

- Strong system skills

- CPA ideal

17

Corporate Tax Accountant Resume Examples & Samples

- Prepare all federal, state, and local tax returns for all US operations - income, franchise, sales/use, and property taxes

- Participate in the month-end, quarter-end, and year-end closing processes. Prepare all tax provision work papers and journal entries as well as quarterly reconciliations

- Assist with special projects, such as transfer pricing, securing various tax credits/incentives, federal/state audits, etc., as needed

- Research federal and state tax issues as they arise

- Bachelor's degree in accounting; master's degree preferred

- 2-5 years of position related experience required

- Experience with Hyperion/HFM is preferred

18

Corporate Tax Accountant Resume Examples & Samples

- Preparing and submitting timely and accurate VAT, ECSL and Intrastat returns across the EMEA region

- Preparing accounting journals relating to tax accounts

- Keeping up to date with developments in EMEA tax legislation and guidance

- Experience in Financial Services

- Strong IT skills, notably Excel and OneSource (Abacus)

- Ability to organise, manage and prioritise work in order to deliver to tight deadlines

- Ability to work as part of a team but to be self-motivated and demonstrate initiative

19

Corporate Tax Accountant Resume Examples & Samples

- Preparation and review of federal and state income taxes, sales tax, income tax provision

- Assist in internal and external audit process

- As needed, assist with AR, AP, fixed assets, reconciliations (bank and G/L), cash management, budget and forecasting

- CPA nice plus

- *Local candidates only please***

20

Corporate Tax Accountant Resume Examples & Samples

- 0-2+ years of experience in a tax accounting role with a focus in corporate U.S., international and state taxation

- Excellent research, documentation and communication and skills

- Experience with Tax Stream and Thompson Reuters OneSource a plus

21

Corporate Tax Accountant Resume Examples & Samples

- Assist in the preparation of year-end provisional computations and statutory accounts notes

- Assist in the provision of information and advice to internal customers

- Through continuous improvement, ensure the tax processes are efficient and delivered in a right first time manner to the business and 3rd parties

- Active participation in cross functional projects

- Qualified/ Part qualified tax professional (CTA / ATT) or relevant HMRC background, with strong tax technical experience

- Professional in approach and dedicated to high standards, with excellent attention to detail and right first time mentality

- Excellent communication skills both written and oral are essential

22

Corporate Tax Accountant Resume Examples & Samples

- Prepare schedules and calculations for federal and state income tax filings

- Prepare income tax extensions and estimated tax payment calculations

- Prepare tax fixed assets schedules and depreciation calculations

- Prepare calculations for non-resident state tax withholdings for partnership members

- Prepare 1099’s and backup withholding calculations

- Analyzing intercompany accounts among federal and international jurisdictions

- Assisting with income tax provisions and quarter end close process

- Performing research on tax issues and preparation of tax research memos

- Assisting tax department with written documentation of tax policies and procedures

23

Corporate Tax Accountant Resume Examples & Samples

- Operations involve facets of private equity investment reporting and compliance

- Numerous international, state and cross functional matters

- 3-5+ years of experience in a tax accounting role with a focus in corporate U.S., international and state taxation

- Public accounting experience preferred

24

Corporate Tax Accountant, Senior Resume Examples & Samples

- Bachelor’s degree in finance or accounting

- Two or more years of experience in multi-state and federal tax

- Prior experience with forms 940 and 941

- An eye for process improvement

- Candidate should be highly organized and be able to multitask

25

Lead Corporate Tax Accountant Resume Examples & Samples

- Perform tax provision calculations, tax research, filing of tax returns and tax audits

- Tax return compliance includes corporate income, franchise, sales and use, value added tax, payroll tax, and property tax filings

- Assist with preparation of quarterly tax account reconciliations and annual deferred tax

- Minimum of 5 years corporate tax experience in a public accounting firm or

26

Corporate Tax Accountant Resume Examples & Samples

- Responsible for coordinating with third parties, and local Finance as required, to ensure completion of timely and accurate local tax and statutory filings

- Coordinate the completion of the US GAAP and local statutory tax provisions for EMEA entities

- Coordinate the recording of tax journal entries as required

- Partner with other members of the European Financial Reporting team on tax and other accounting related issues

27

Corporate Tax Accountant Resume Examples & Samples

- Support tax compliance, audit, and tax accounting functions

- Interacts with key client management to gather information, resolve tax-related problems, and makes recommendations for business and process improvements

- Gathers and reports information for state and local income tax audits

- Ability to analyze and solve problems in a timely manner

- Solid organizational skills

- Discreetly handle confidential information

28

Corporate Tax Accountant Resume Examples & Samples

- 2 or more years of corporate tax experience

- Experience with tax preparation software, strongly preferred

- Tools and process enabling remote connection to internal systems

- Excellent skills in Microsoft Office

29

Senior Corporate Tax Accountant Resume Examples & Samples

- Collection of data and analysis around state, local and foreign audit inquiries

- Research tax law and accounting principles and drafts technical memos or outlines

- Preparation and review of tax return workpapers and filings, including preparation of foreign-related tax filings

- Assist with transfer pricing model and analysis, R&D Tax Credit modeling, Foreign Tax Credit modeling, presentations, etc

30

Senior Corporate Tax Accountant Resume Examples & Samples

- Preparing and filing federal income tax returns – including Form 1120 and 1065

- Preparing and filing state income tax returns

- Making quarterly tax payments – at Federal and State Level

- Assisting with the tax preparation of the annual tax provision

- Various other income-tax related projects, including tax regulation research

- Review and Monitor Fixed Asset activity within Fixed Asset System

- Monitor Depreciation Expense for book and tax purposes

- Over 3 years to 5 years’ experience in Accounting

- Experience preparing federal and state income tax returns

31

Corporate Tax Accountant Resume Examples & Samples

- Preparation of the UK Corporation Tax Returns, meeting all compliance filing and payment deadlines

- Monitor and coordinate UK and overseas tax positions of business unit entities

- Prepare quarterly tax outlook, quarterly and annual reporting figures, and tax figures for inclusion in long-term cash flow forecasts. Liaise with external auditors as required

- Pro-actively liaise with the UK and US tax team to identify and explain UK/overseas tax issues and the impact on the group’s world-wide tax position

- Preparation/review of tax disclosures for UK and overseas financial statements (including consolidated tax numbers, where required)

- Monitoring and coordination of business unit international strategy from a tax perspective, advising on implications and monitoring/documenting risks

- Periodic review of compliance and reporting processes and controls, with a view to continuous improvement. Assist with SAO/SOX sign-off process

- Support the Head of Tax with project work, business integrations, policy matters and interact as necessary with other corporate functions

- Assist with development of transfer pricing positions and documentation

- Based in London, but working across London offices and journeys to Peterborough as required

- Graduate qualified tax professional with a recognised accounting and/or tax qualification and at least 4-5 years’ post-qualified experience, either in a blue chip corporate or a leading tax advisory firm

- Strong tax compliance, technical and accounting skills. International tax experience beneficial

- Able to work on their own initiative with excellent interpersonal skills and commercial acumen

- A high level of IT literacy in Microsoft Office packages; SAP and AlphaTax preferable but not essential

- An ability to master the detail yet retain a strategic viewpoint

- Well-developed relationship building skills, both with colleagues and the broader team; able to gain support and respect for proposals across organisational boundaries

- The ability to identify and seize opportunities for different and innovative approaches, challenges and solutions. Able to focus on the most important things and take actions to overcome obstacles and seek solutions

- The ability to manage and develop individuals, whilst creating and inspiring commitment

32

Senior Corporate Tax Accountant Resume Examples & Samples

- Prepares federal tax returns for assigned legal entities, for inclusion in corporate consolidated return

- Prepares state income and franchise tax returns for assigned legal entities

- Prepares estimated tax payments

- Conducts tax research either on a project basis, or as needed to support assigned legal entities

- Sound understanding of accounting rules and procedures in accordance with GAAP

- Understanding of state and federal taxes

- Team player, with ability to work independently and with minimal supervision

- Able to multi-task, handling a broad range of duties and requests

33

Corporate Tax Accountant Resume Examples & Samples

- Assist with preparation of U.S. Federal income tax return

- Ability to communicate effectively with all levels of management

- Excellent teamwork skills with proven ability to work effectively in a variety of situations

- Excellent organizational, time management and prioritization skills

- Highly detail oriented with exceptional follow-up and sense of urgency

- Not required, but a plus

- 2 – 4 years of tax compliance experience

- Public accounting firm experience preferred(i.e. JohnSmithResume.pdf or JohnSmithResume.doc)

34

Senior Corporate Tax Accountant Resume Examples & Samples

- Bachelor’s or Master’s Degree in Accounting

- Minimum of four (4) years of relevant experience in taxation with a large multi-state corporation or national public accounting

- Master’s Degree in Accounting

- Ability to work independently or with a team

- Ability to clearly present ideas and summarize complex issues, both in writing and verbally

- Desire for continuous professional development through experience and continuing education

- Desire for continuous improvement in Tax Department processes to achieve efficiencies and greater accuracy

- Desire to build relationships with others within the organization to facilitate increased communication and opportunity for adding value

- Experience using CORPTAX a plus

- Proficient in standard Microsoft applications (i.e., Excel, PowerPoint, and Word)

35

Corporate Tax Accountant Resume Examples & Samples

- Preparation of federal and state corporate income tax returns, both consolidated and stand-alone entity

- Participates in the interaction with operating company management, third party advisors, external advisors and taxing authorities on tax compliance, planning and controversy issues

- BS/BA in Accounting required. Masters Degree in tax or accounting a plus

- Corporate Tax experience, 5 plus years preferred, public accounting tax experience preferred

- Experience in preparing federal and/or state corporate income tax returns required

- Experience in preparing consolidated federal and state corporate income tax returns preferred

- Excellent computer skills with Microsoft Excel and Adobe Acrobat

36

Corporate Tax Accountant Resume Examples & Samples

- Prepares and timely files state corporate income and franchise tax compliance including timely requests for key source documentation and preparation of applicable tax work papers. Prepares apportionment schedules for state corporate income and franchise tax returns.’s Business/General Ledger and Federal Tax positions in order to understand new opportunities and liabilities for State Tax

- Prepares and timely files state corporate income and franchise tax compliance including timely requests for key source documentation and preparation of applicable tax work papers. Prepares apportionment schedules for state corporate income and franchise tax returns

- Prepares accurate and timely calculations/filings of state and local corporate estimated tax payments and extension requests

- Communicates with state taxing authorities via verbal and written correspondence to bring state tax notices to a positive resolution and keeps a running status for outstanding and fully resolved notices

- Prepares all necessary applications for tax credits and incentives, keeping status list of outstanding items, and researches new opportunities for tax credits and incentives

- Develops a solid understanding of Vanguard’s Business/General Ledger and Federal Tax positions in order to understand new opportunities and liabilities for State Tax

- Maintains comprehensive tax calendar for state and local filing requirements. Researches and prepares tax technical memos as directed by management

- Maintains up-to-date policies and procedures for tasks specific to job function. Proactively seeks ways to improve current processes and workflows that enhance overall effectiveness and efficiency

- Assists in the quarterly and year-end calculation of corporate tax provision (ASC 740 – Accounting for Income Taxes) including variance analysis, periodic projections, and updates to ASC 740-10

- Assists with corporate income and franchise tax audits by various state and local auditors

- Assists with the Value-Added Tax compliance function, as needed

- Participates in external tax/accounting organizations (such as Tax Executives Institute and the Council on State Taxation). Monitors technical tax research websites for pertinent updates to state and local announcements, revenue rulings, procedures, and other publications to keep abreast of legislative and regulatory developments

- Establishes and maintains excellent working relationships with peers, management, and internal clients. Responds to business area inquiries and communicate technical information clearly and concisely through verbal and written communications

- Exemplifies commitment to quality by leveraging Vanguard Unmatched Excellence (“VUE”) efforts. Attends requisite personal and technical training and understands links to Department, Division, and Corporate dashboards

- Coordinates and communicates effectively with all members of Tax Department regarding all filings and estimates

- Undergraduate degree in Accounting or Finance, or equivalent combination of training and experience

- Minimum three years relevant corporate tax experience in industry or public accounting

- Experience with OneSource/GoSystems preferred

- Federal Tax experience a plus

- Proficient with Microsoft Office and familiar with People Soft general ledger system

- Strong written and verbal communication skills and ability to interact with all levels of management

- Ability to take initiative and work independently with minimal supervision

37

Corporate Tax Accountant Resume Examples & Samples

- Advanced understanding of the corporate income tax process

- Ability to synthesize tax regulations and case law; along with operations to optimize tax

- Positions and compliance efficiency

- Ability to interpret a variety of instructions furnished in written, oral, diagram

- Strong financial data management foundation and data extract skills

- Solid organization and productive: ability to work independently and manage multiple priorities in a deadline-driven environment

- Strong project management skills and a relentless focus on process improvement

- Initiative and a desire to take on new challenges and responsibilities

- Ability to work cross-functionally and across geographies with local controllers and other Finance personnel to obtain information required for returns and other projects

- · Solid verbal and written communication skills required

- Experience and Education preferred

- 4+ years of experience in multiple tax projects

- International taxation, a plus

- Knowledge of PeopleSoft Financials, a plus

- Advanced knowledge of Microsoft Office software

- OneSource (FastTax) software experience, a plus

- CPA or Masters in Taxation, MPA a plus (not required)

38

Corporate Tax Accountant Resume Examples & Samples

- Participate in all aspects of federal and state tax compliance including preparation of consolidated federal and state corporate income tax returns, supporting schedules, estimated tax payments, partnership tax returns and extension filings

- Prepare international aspects of the federal income tax return, including foreign tax credit documentation, Forms 1118, 5471, 8858 and 8865, and the supporting documentation for these schedules

- Assist with year-end income tax provision for financial reporting related to US and international operations. Team with International Tax Managers and local Controllers to collect information for year end

- Work with tax team on tax analysis, planning and forecasting

- Support tax team in responding to International, Federal and State tax audit queries as required

- Assist in research of federal, state and local tax issues as required

- Perform administrative and general work as required to achieve results accurately, efficiently and effectively

- BS Degree, Accounting concentration

- 1-2 years of “Big 4” public accounting corporate tax experience (or equivalent combination of public and industry experience in multinational corporate environment) strongly preferred

- US corporate and state income tax compliance experience required

- Strong accounting and quantitative skills

- Self-starter with ability to balance multiple projects

- Strong interpersonal and project management skills

- Strong computer skills, including proficiency in Microsoft Word and Excel, and preferably experience with OneSource corporate module and online tax research

39

Senior Corporate Tax Accountant Resume Examples & Samples

- S corporate tax, state, partnership, LLC, individual

- Trust and foundation tax accounting

- Tax research and preparation of returns

- Sales & Use property tax returns

- Estimated payment preparations

- CPA and/or working towards preferred

- Ability to work well with a team

40

Corporate Tax Accountant Resume Examples & Samples

- B.A. with a major in Accounting or Finance

- 2-5 years work experience in public accounting or a corporate tax department

- CPA preferred, but not required

41

Senior Corporate Tax Accountant Resume Examples & Samples

- Bachelor’s Degree in Accounting or Finance required, CPA and/or MST preferred

- 3–5 years of experience in tax required

- Must have knowledge of tax rules and regulations

- Ability to collaborate in a cross functional team environment and be a strong communicator with the ability to interact with all levels of corporate staff and management

- Strong knowledge of excel

- Ability to manage a broad range of activities and multi-task

- Strong attention to detail is a must

- Demonstrates a desire to learn and assume responsibility

- Self-starter who can work independently as well as part of a team

42

Corporate Tax Accountant Resume Examples & Samples

- Preparation of complex Federal and state corporate income tax returns

- Assist in quarterly and annual tax provision

- Perform tax research and assist with tax planning initiatives

- Prepare and file quarterly estimated tax payments

- CPA or M.S. in Taxation highly preferred

- Minimum of five years of corporate tax experience

- Big 4 or national firm experience is a huge plus

- Strong experience with tax provision (ASC 740) is required

43

Corporate Tax Accountant Resume Examples & Samples

- 5 - 7 Years Payroll Tax Experience

- Strong attention to detail and execution

- Strong business acumen, e.g. ability to interpret and apply financial data/information to business decisions

- Strong business partnering skills

- Detail-oriented, organized and capable of prioritizing workload to complete multiple tasks and meet aggressive deadlines

- Proficient in Microsoft Office, Windows, Excel and PowerPoint