Paraplanner Resume Samples

4.7

(105 votes) for

Paraplanner Resume Samples

The Guide To Resume Tailoring

Guide the recruiter to the conclusion that you are the best candidate for the paraplanner job. It’s actually very simple. Tailor your resume by picking relevant responsibilities from the examples below and then add your accomplishments. This way, you can position yourself in the best way to get hired.

Craft your perfect resume by picking job responsibilities written by professional recruiters

Pick from the thousands of curated job responsibilities used by the leading companies

Tailor your resume & cover letter with wording that best fits for each job you apply

Resume Builder

Create a Resume in Minutes with Professional Resume Templates

CHOOSE THE BEST TEMPLATE

- Choose from 15 Leading Templates. No need to think about design details.

USE PRE-WRITTEN BULLET POINTS

- Select from thousands of pre-written bullet points.

SAVE YOUR DOCUMENTS IN PDF FILES

- Instantly download in PDF format or share a custom link.

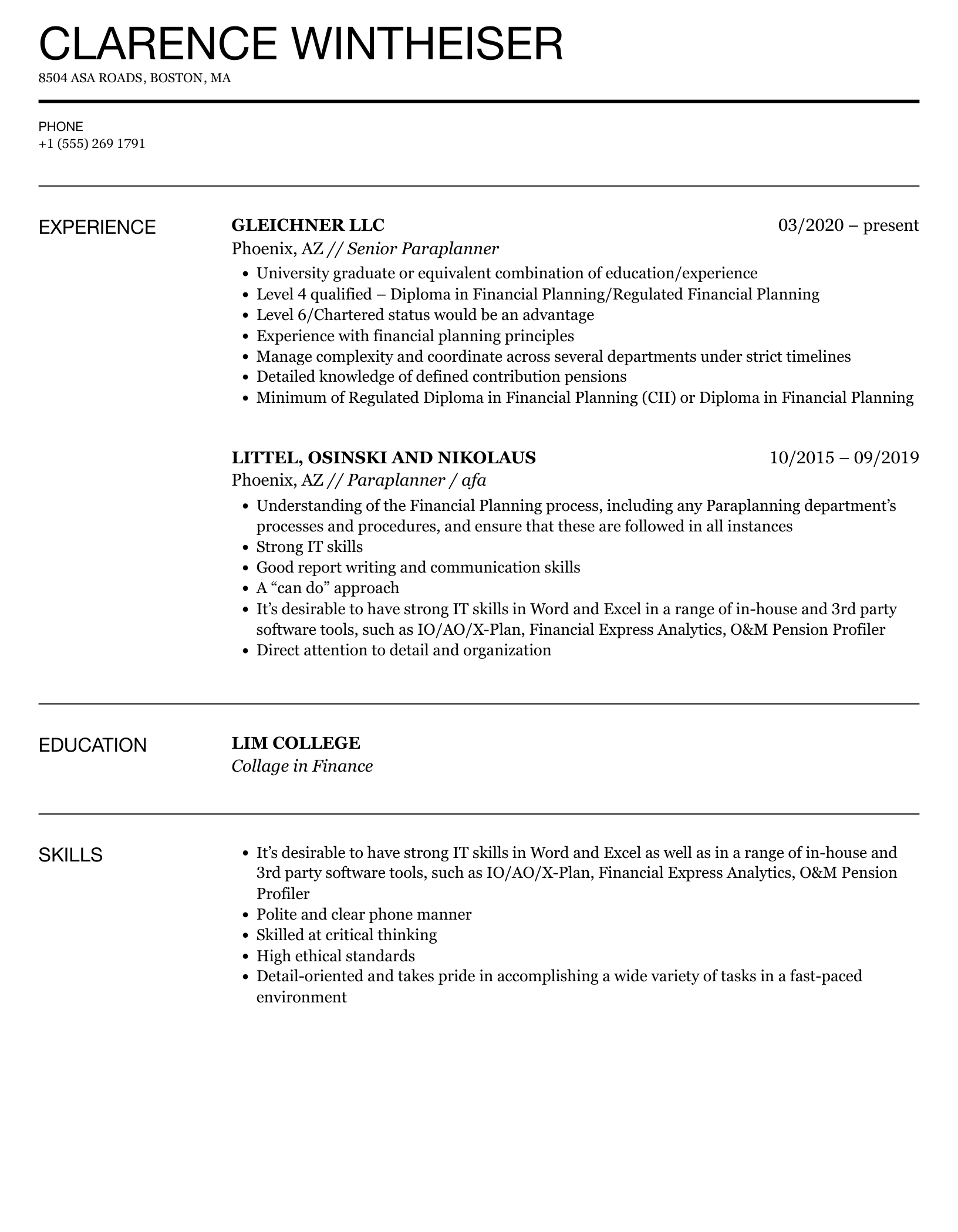

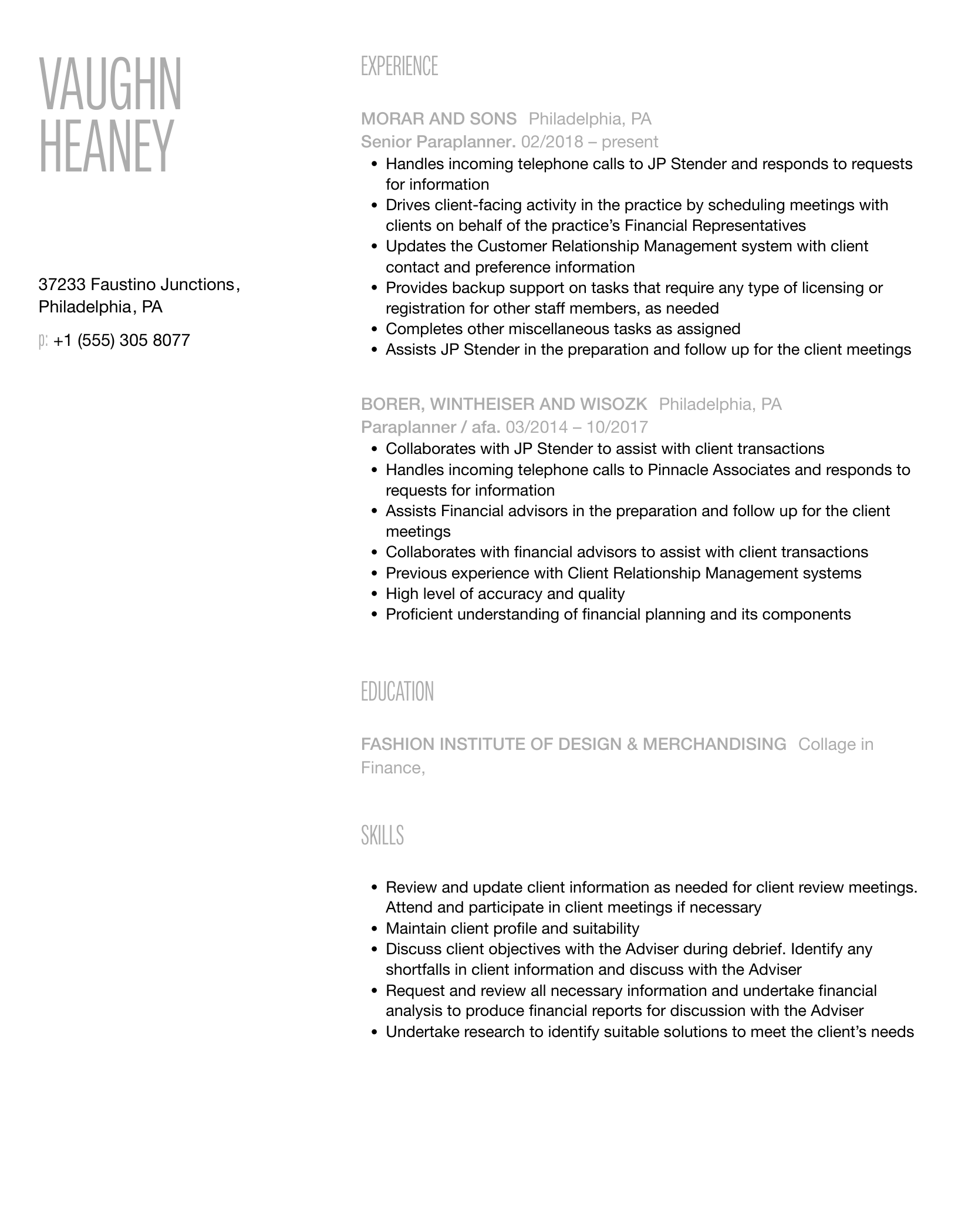

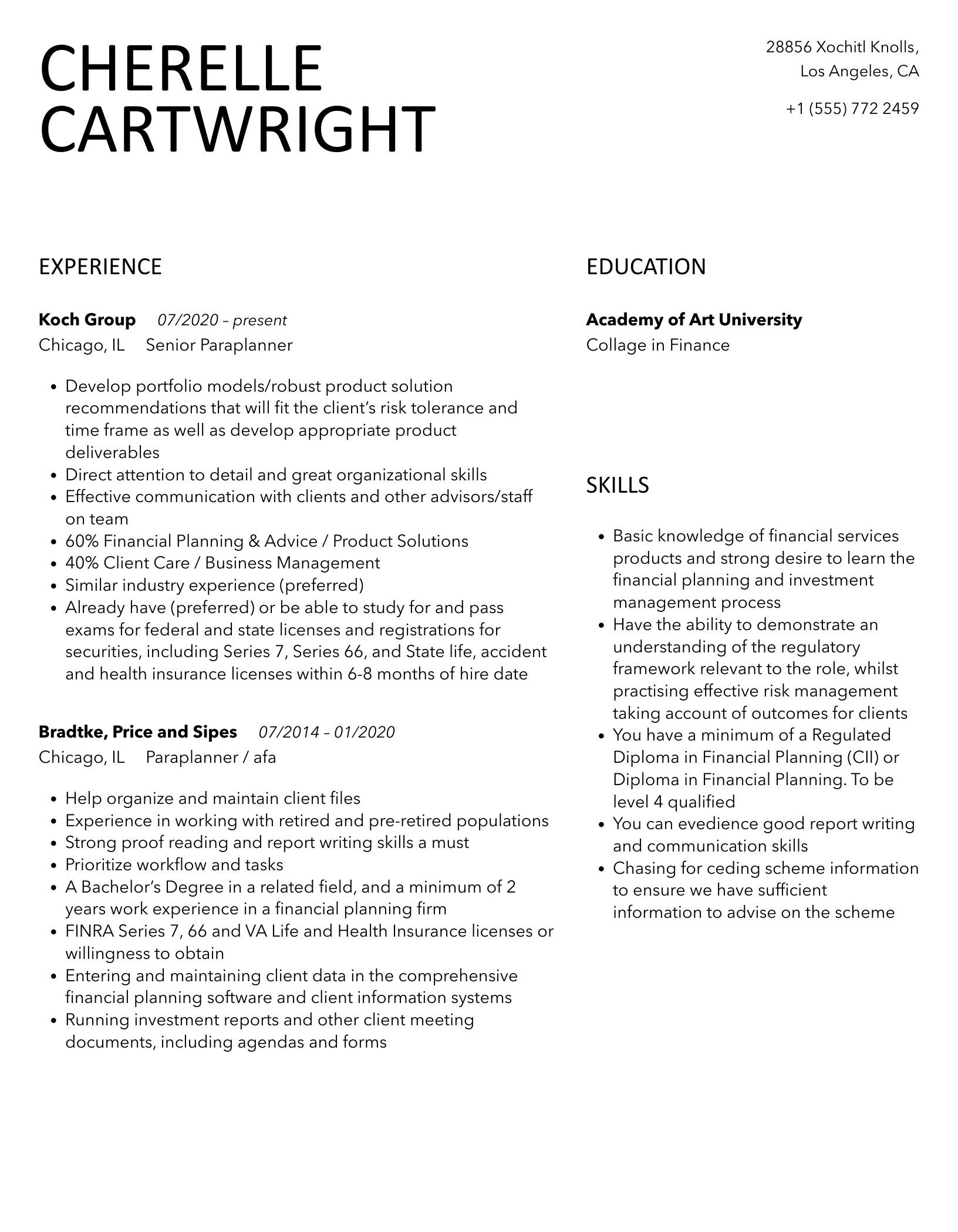

AB

A Beatty

Allene

Beatty

32553 Krajcik Plains

Houston

TX

+1 (555) 801 2625

32553 Krajcik Plains

Houston

TX

Phone

p

+1 (555) 801 2625

Experience

Experience

New York, NY

Paraplanner

New York, NY

Streich-Toy

New York, NY

Paraplanner

- Develop and maintain checklists for tracking periodic investment managers' reviews by third party and independent investment manager searches

- Provide occasional administrative assistance to FA (online research, formatting documents, etc.)

- Submit paperwork when advice taken up in accordance with Company procedures. Ensure all paperwork is in order

- Manage external SoA providers for quality and timely delivery

- Create portfolio snapshots, researching investments and providing fund reports upon request to clients

- Assist financial advisor in the preparation of written Client Service Review materials and financial planning/investment letters and proposals

- Ensure that the advice provided to individual clients is the best advice

Chicago, IL

Paraplanner / afa

Chicago, IL

Lang-Hammes

Chicago, IL

Paraplanner / afa

- Performing case analysis

- Perform other duties as assigned by the advisor

- Developing recommendations

- Answer client questions as it relates to servicing their accounts

- Organizing and archiving financial planning data for each client

- Conducting client meetings for data

- Preparing for client meetings

present

Houston, TX

Senior Paraplanner

Houston, TX

Corwin and Sons

present

Houston, TX

Senior Paraplanner

present

- Paraplanning workflow management

- Manage planning workflow

- Performing detailed financial modelling and scenario analysis using Xplan

- Produce and maintain Reports and MI Business Trackers for the management team

- Provide information for annual reviews and identify areas not covered

- Provide technical support to the Financial Planners and remaining up to date on legislative and industry changes

- Build strong working relationships with clients, both face to face and remotely

Education

Education

Bachelor’s Degree in Bachelor

Bachelor’s Degree in Bachelor

University of Massachusetts Amherst

Bachelor’s Degree in Bachelor

Skills

Skills

- Prepare presentations and proposals for High Net Worth and institutional clients and prospects

- Coordinate efforts to gather data and assist Financial Advisors in preparing responses to requests for proposals (RFPs)

- Prepare portfolio analyses for High Net Worth and institutional clients

- Assist with drafting and maintaining investment policy statements (IPS) for clients

- Assist Financial Advisors with on site presentations to clients and prospects

- Assist Financial Advisors with initial setup of client accounts and on-going monitoring

- Generate periodic reports on investment analyses and peer group comparisons with relevant investment benchmarks for clients

- Create portfolio snapshots, researching investments and providing fund reports upon request to clients

- Assist Financial Advisors to customize their marketing materials, including pitch books, communication campaigns, newsletters, etc

- Develop and maintain checklists for tracking periodic investment managers' reviews by third party and independent investment manager searches

12 Paraplanner resume templates

Read our complete resume writing guides

1

Paraplanner Resume Examples & Samples

- Coordinate efforts to gather data and assist Financial Advisors in preparing responses to requests for proposals (RFPs)

- Prepare portfolio analyses for High Net Worth and institutional clients

- Assist with drafting and maintaining investment policy statements (IPS) for clients

- Assist Financial Advisors with on site presentations to clients and prospects

- Generate periodic reports on investment analyses and peer group comparisons with relevant investment benchmarks for clients

- Create portfolio snapshots, researching investments and providing fund reports upon request to clients

- Assist Financial Advisors to customize their marketing materials, including pitch books, communication campaigns, newsletters, etc

- Develop and maintain checklists for tracking periodic investment managers' reviews by third party and independent investment manager searches

- Company's working structure, policies, mission, strategies and compliance guidelines

- Client Relations Management tools

- Preparing and delivering clear, effective and professional presentations

- Use appropriate interpersonal styles and communicate effectively, both orally and in writing, with all organizational levels

- Keep all appropriate parties up-to-date on decisions, changes and other relevant information

- Establish and maintain effective working relationships with others

2

Paraplanner CFP Preferred Resume Examples & Samples

- Prepare presentations and proposals for High Net Worth and institutional clients and prospects

- Assist Financial Advisors with initial setup of client accounts and on-going monitoring

- Performs other duties and responsibilities as assigned

- Investment concepts, practices and procedures used in the securities industry

- Financial services news and data resource tools

- Investment management analytical tools

- Financial Planning software tools

- Operating standard office equipment and using required software applications to produce correspondence, reports, electronic communications, spreadsheets and databases

- Identifying the needs of customers through effective questioning and listening techniques

- Organize, manage and track multiple detailed tasks and assignments with frequently changing priorities and deadlines in a fast-paced work environment

- Continuously learn investment products, industry rules and regulations and financial planning software

- Use mathematics sufficient to process account and transaction information

- Self motivated and able to work independently

- Bachelors degree in Bachelor's Degree in Business, Economics, Finance or a relate field)

3

Wealth Management, Paraplanner, Perth Branch Resume Examples & Samples

- Preparing comprehensive SoA's that range from simple to complex strategies, and which may include both investment and insurance advice, that are compliant with internal policies, compliance and the law

- Ensuring all SoA's are completed in a timely, accurate and compliant manner, following the standard steps of the planning process and keeping in line with internal requisites

- Providing assistance with financial modelling and development of wealth strategies for high net worth clients

- Assisting the Financial Planners with the provision of financial planning services and advice to existing and new clients

- In conjunction with the Financial Planner, assisting with the preparation and completion of strategic annual review SoAs for clients

- Written and verbal and influencing skills

4

Senior Corporate Paraplanner Resume Examples & Samples

- A proven track record gained within a financial services environment primarily focused on corporate clients - knowledge of Auto-enrolment and Employee benefits is essential as is knowledge of how DC and DB company pension schemes work

- Studying for Certificate in Financial Planning or equivalent qualifications. Any progress towards Diploma in Financial Planning via J01-J08 or R01-R06 would be advantageous

- Previous report writing skills

- Previous experience of Intelligent Office (IO) database system desirable but not essential

- Computer literate e.g. Excel, Word, PowerPoint, Outlook, Morningstar

- Attention to detail and a quality approach

- Organisational and problem solving abilities

- Good spoken and written communication skills

- Committed approach to work

- Displays potential to grow within the role

- The successful applicant must be able to drive as our office is located in the Surrey Hills and public transport is infrequent

5

Senior Paraplanner Brisbane Resume Examples & Samples

- Develop strategically accurate and timely Statements of Advice (SoAs)

- Active participation in process improvements within the business

- Providing Technical support to advisers and peers

- Engaging in continuous learning and knowledge sharing

- Previous experience in a Paraplanning role

- Previous strong experience with Xplan

- Strong technical skills and the ability to prepare strategic SOAs

- Experience with COIN would be advantageous

- Strong commercial acumen

- An advanced diploma in Financial planning

- CFP qualification, completed or in progress would be highly regarded

6

Paraplanner Resume Examples & Samples

- Has primary responsibility for all preparation for client meetings, including paperwork preparation, and preparing presentation materials

- Prepares and delivers correspondence and other client communication

- Assist Advisors with several important elements of the financial planning process, including, and not limited to: Collecting all required data from current or prospective client, including assets, liabilities, insurance policies, estate documents, and tax returns. Inputting retirement planning information into planning software

- Work collaboratively with Advisors throughout the planning process to ensure that

- College degree in business administration, finance or related field preferred

- Proven experience working in client support, portfolio management, relationship management or Paraplanner role, preferred within the financial services industry

- Keen attention to detail and highly developed analytical skills

- Proven ability to prioritize, self-manage and proactively solve problems

- CA Insurance, Series 7 and Series 66 Licenses a plus for this position

- Ameriprise Financial Paraplanner experience advantageous

7

Paraplanner Resume Examples & Samples

- Inputs data into financial planning software and the develops of initial planning recommendations

- Assists with ongoing portfolio monitoring and account maintenance

- Interacts with other team members and departments to coordinate the delivery of service to clients

- Provides efficient and accurate year-end tax information to CPAs

- Bachelor’s degree in related field required

- 1 year of wealth management and investment advisory experience preferred

- Experience in a public accounting or professional services firm environment preferred

- Insurance knowledge preferred

- Series 65 preferred and/or willing to obtain within 180 days of hire

- Experience with CRM, portfolio accounting, rebalancing and or financial planning software preferred

- Excellent communication, organizational, and client relationship skills

- Ability to work on multiple projects at once while consistently completing projects on time and with few revisions

- Understands firm’s wealth management process

- Ability to function as part of a regional team

- Ability to think critically, take initiative and problem-solve

- Ability to comfortably maintain poise and diplomacy amongst both client and company personnel

8

Paraplanner / afa Resume Examples & Samples

- Preparing for client meetings

- Creating personal financial analyses

- Performing case analysis

- Developing recommendations

- Executing trades to align with proposed portfolio

- Special projects

- Client service

- Candidate should be well organized, efficient, have strong attention to detail, be able to work independently, take initiative, and possess great interpersonal skills

- We seek a candidate who already has their federal and state licenses and registrations for securities, including Series 7, Series 66, State life, accident and health insurance licenses. This position will consistently follow high standards of business and professional ethics and legal and and regulatory requirements when dealing with others and/or performing work activities

9

Paraplanner Resume Examples & Samples

- Prepare, present to FA and assist in implementing customized financial plans. Prepare retirement cash flow and net worth statements, life and disability insurance quotes, and long-term care insurance quotes

- Complete trades and transactions

- Prepare paperwork needed for prospect and client meetings

- Prepare and meet with prospects/clients to sign investment, annuity and life insurance applications

- Assist Advisor with meeting individual goals

- Review notes from all prospect/client meetings, gather data and prepare forms, illustrations, quotes and any additional reports needed for appointments. Contact clients to obtain missing data to prepare plans

- Prepare and maintain a variety of client performance and analytic reports

- Persistence to achieve goals and ability to fulfill unique role in a cooperative team environment

- Assist with maintaining compliance reports

- Maintain familiarity with all technology used – MS Office, Thomson Brokerage, Morningstar, and Financial Planning tools

- Correspond with clients and resolve client service issues

- Assist with documenting Operations/Appointment Prep procedures and keep training manuals updated

- Provide occasional administrative assistance to FA (online research, formatting documents, etc.)

- Have basic understanding of investment products used and recommended for prospects/clients

- 2+ years financial services experience

- Security license Series 7 & 66 (MN insurance license preferred, but not required) or willing to obtain in the first 180 days

- High standards of business/professional ethics

- Strong organizational, prioritization and interpersonal skills

- Excellent communication skills; both verbal and written

- Proficient with MS Office Suite (Outlook, Excel, Word and Power Point)

10

Sales Assistant\paraplanner Resume Examples & Samples

- Collects, validates, and analyzes financial data

- Open new accounts, processing trades & rebalancing portfolios

- Assists with ongoing net worth and portfolio monitoring and plan and account maintenance

- Assist with processing insurance & annuity business as needed and run illustrations

- Additional administrative projects as assigned

11

Paraplanner / Planning Assistant Resume Examples & Samples

- Entering and maintaining client data in the comprehensive financial planning software

- Running investment reports and other client meeting documents, including agendas and forms

- Placing trades in the market and other client account related activities

- Following up with the corporate office on client related issues

- Help with calendaring and meeting confirmation emails

12

Paraplanner\registered Assistant Resume Examples & Samples

- Inputs data into financial planning software and develops initial planning recommendations

- Provides ongoing support of client relationships, handles day-to-day client requests and issues

- Additional projects as assigned

13

Paraplanner Resume Examples & Samples

- Provide support in regard to

- Meeting preparation, data gathering and data entry

- Prepare & process new business

- Prepare client correspondence

- Client service, care and follow up

- Client scheduling

- Coordinate client appreciation events and seminars

- Other administrative, marketing and operational tasks

- At least 2 years industry experience

- Series 7 License (required)

- Series 66 License and CA Insurance License (preferred)

14

Junior Paraplanner Resume Examples & Samples

- Assist the senior paraplanner in preparing for financial planning client meetings

- This position will entail utilizing Excel, PowerPoint, and NaviPlan

- The person should be analytical, be proficient with Excel and PowerPoint, and have a desire to have a career in financial planning as a paraplanner

15

Portfolio Administrator / Paraplanner Resume Examples & Samples

- Completing portfolio trades with critical attention to timeliness and accuracy

- Assisting with transactions related to outside accounts

- Preparing asset allocation grids for clients

- Administering investment-related paperwork on accounts

- Moving money to support client needs

- Researching portfolio related data (e.g. cost basis, tax information)

- Reporting portfolio-related deliverables to corporate Ameriprise

- Investigating and resolving client service problems/needs

16

Paraplanner Resume Examples & Samples

- Preparing comprehensive Statements of Advice (SoA's) that range from simple to complex strategies, and which may include both investment and insurance advice, that are compliant with internal policies, compliance and the law

- Ensure all SoA's are completed in a timely, accurate and compliant manner, following the standard steps of the planning process and keeping in line with internal requisites

- Constructing financial modelling utilising financial planning software (XPLAN)

- Provide assistance with financial modelling and development of wealth strategies for high net worth clients

- Assist the Financial Planners with the provision of financial planning services and advice to existing and new clients

- In conjunction with the Financial Planner, assist with the preparation and completion of strategic annual review SoAs for clients

- Ensure that all client information is entered into the appropriate client management system accurately

- Ensure that workflow and other relevant database information is kept up to date

- Maintain and develop strong relationships with the financial planners

- Comply with the ethical standards contained within the Company Code of Conduct

- Technical/Specialist skills/competencies

- Strong Superannuation knowledge including SMSF’s

- Personal Insurance Knowledge

- Statement of advice construction

- Technically sound

- Financial Planning Advice Process

- Experience utilising XPLAN financial planning software for construction of SoA’s including modelling/projections, investment and insurance advice

- Business/Industry knowledge/competencies

- Sound understanding of investment and insurance products, preferred

- Sound understanding of equity markets is an advantage

- Sound understanding of structure and entities also an advantage

- Personal Attributes/Interpersonal skills

- Excellent communication (both written and verbal) and influencing skills

- Ability to work under pressure and to tight timeframes within a team

- Ability to build rapport with people (in local office, across branches nationwide & different organizations)

- Goal-oriented with demonstrated drive and initiative

- Tertiary qualifications preferred in a related field (eg Commerce, Economics)

- Successfully completed Advanced Diploma of Financial Planning (1-8) or currently studying toward ADFP - Preferably min DFS (1-4)

- 2 + years paraplanning experience (in a similar role)

17

Paraplanner Resume Examples & Samples

- Prepare charts, graphs, tables and other visual aids to be used in implementation meetings with clients

- Develop portfolio/robust product solution recommendations that will fit the client’s risk tolerance and time frame as well as develop appropriate product deliverables

- Maintain client contact during the financial planning process. Answer questions and provide readily available information to clients, if requested and as allowable, as it relates to servicing their accounts

- Review and update client information as needed for client review meetings. Attend and participate in client meetings if necessary

- Manage and resolve client service problems

- Perform other allowable duties as assigned by the financial advisor(s)

18

Paraplanner Resume Examples & Samples

- Prepare financial plans, analysis and recommendations based on consultations with advisor(s) for individual clients using proprietary software and tools

- Execute client securities trades and transactions along with money movement

- Process and track account transfers, annuity applications and various other product solutions

- College degree or higher

- Experience with Microsoft Excel and Word required- Powerpoint also recommended

- Technologically savvy, ability to work with computers and the internet with ease

- 2+ years of similar experience

- Already have or be able to study for and pass exams for federal and state licenses and registrations for securities, including Series 7, Series 66, and State life, accident and health insurance licenses

- Substantial Experience with Microsoft Excel and Word required

- Knowledge of financial products and services highly recommended

19

Paraplanner Resume Examples & Samples

- Assist financial advisor in the preparation of written Client Service Review materials and financial planning/investment letters and proposals

- Review client financial statements, documents and other data

- Prepare financial planning recommendations for the client

- Provide investment and financial planning research

20

Sales Assistant / Paraplanner Resume Examples & Samples

- Implement trades, transactions and money movements as directed by advisors

- Collect client financial statements, documents and other data

- Interact with clients, peers and corporate office employees to solve problems, facilitate operations and solicit information as needed

21

Ipac Paraplanner Resume Examples & Samples

- Prepare high quality and compliant Statements of Advice and other advice documents on behalf of planners

- Meet and exceed individual productivity targets

- Ensure that Paraplanning qualitative and quantitative service standards are met

- Ensure that Paraplanning services are in accordance with licensee standards

- Ensure high level financial planning software skills are developed and maintained

- Build and reinforce a constructive and high performing culture (individually and collectively as a team member)

- Maintain minimum education requirements

22

Paraplanner Resume Examples & Samples

- Entering and maintaining client data in comprehensive financial planning software (Naviplan)

- Interact with the corporate office on client related issues

- Prepare and coordinate information for financial advisors’ meetings with clients

- Provide excellent service support to new and existing clients

- Must have a 4 year college degree and a minimum of 3 years industry/related experience. CPA or CFP preferred

- Series 7 & Series 66 licensed or willing to get licensed within a reasonable amount of time. OH Life, Accident & Health License (LAH) will also be required

- Strong technology skills including a high level of computer efficiency including Microsoft Office Tool Suite

- Excellent interpersonal skills and general desire to serve and care for other people

- Strict attention to detail and strong organization skills

- Effective and efficient time management

- Self-starter who is able to self-teach when given the appropriate resources

- Likes to work proactively not reactively

- Enjoys systems; building, evaluating, implementing, and sticking to them

23

Paraplanner Resume Examples & Samples

- Prepare written Client Service Review materials and financial planning/investment letters and proposals after client meetings

- Review client financial statements, documents and other data. Maintain client records and comply with all FINRA regulations

- Prepare financial planning recommendations, meeting agenda, and deliverables for the client meetings

- Must have excellent attention to detail and be well organized

- Basic knowledge of financial services and investment management process

- Must have a 4 year college degree and a minimum of 2 years industry/related experience

- Series 7 & Series 66 licensed or willing to get licensed within a reasonable amount of time

- High level of computer efficiency including Microsoft Office, Outlook and Adobe

- Must be able to multi-task and have a polite and clear phone manner

- The ability to work independently and strong interpersonal skills and client service experience is a plus

24

Paraplanner / Financial Advisor Assistant Resume Examples & Samples

- 60% Financial Planning & Advice / Product Solutions

- Prepare preliminary financial planning recommendations and initial product solutions for advisor review and use in client meetings

- 40% Client Care / Business Management

- Perform other allowable duties as assigned by the financial advisors

25

Paraplanner Resume Examples & Samples

- 50% Financial Planning & Advice / Product Solutions

- Perform case analysis and prepare preliminary financial planning recommendations and/or initial product solutions for advisor review and use in client meetings

- Determine client suitability profile including investment experience and objectives, risk tolerance, timeframe / horizon, income and liquidity needs, and existing portfolio holdings

- Formulate portfolio / robust product solution recommendations that will fit the client’s suitability profile

- Run investment reports and insurance illustrations

- Develop appropriate product deliverables

- Monitor economy, markets, and world events to determine any required strategic rebalancing recommendations

- Meet with wholesalers to evaluate / recommend potential product offerings

- 50% Client Care / Business Management

- Facilitate both incoming and outgoing client communications as required / allowed via e-mail, telephone or face-to-face meetings as it relates to servicing their accounts

- Review and update client information as needed for client review meetings

- Attend and participate in client meetings if necessary

- Review work methods and procedures for possible quality improvements / efficiencies and implement them when appropriate

- Act as a technical resource and provide training and support to other practice members

- Serve as a backup in executing trades and conducting transactions on behalf of clients

26

Client Service Manager / Licensed Paraplanner Resume Examples & Samples

- 30% Business Management

- Work with Home 0ffice to ensure accurate account set-up and resolve issues

- Generate new business applications & other forms and manage through to completion

- Perform other allowable duties as defined by franchise owner

- 70% Client Care

- Maintain contact management system and input client update data as necessary

- Investigate & answer routine requests & resolve issues with sense of urgency (over the phone, email, and in person)

- Input transactions with above average accuracy on behalf of clients (via proprietary on-line systems)

- Assist clients with technology education and usage

- Strong and articulate written and verbal communication skills

- Track client special events and make appropriate contact per established client contact model

- Perform financial calculations to support financial transactions

- Support financial planning process, data collection and ensuing actions

27

Paraplanner Resume Examples & Samples

- Associates degree or higher

- 3-5 years industry experience

- Basic understanding of investment and financial planning strategies

- Ability to identify and follow through with client needs & requirements

- Must be a self-starter, problem solver and goal oriented team player with a “no job is beneath me” attitude

- Organized with a strong attention to detail

- Proficient in Microsoft Excel, Word & PowerPoint

28

Paraplanner / afa Resume Examples & Samples

- Timely delivery of client meeting summary letters

- Conducting client meetings for data

- Completing client friendly and compliant deliverables while meeting required deadlines

- Managing plan payments for all financial planning engagements

- Organizing and archiving financial planning data for each client

- Data collection and follow up for data

- Entering client data into various Financial Planning Tools

- Prepare supporting documentation for client meetings

- Conduct and/or participate in client meetings to present recommendations/deliver advice

- Maintain client contact during the financial planning process

- Track/hold clients accountable to agreed upon actions

- Answer client questions as it relates to servicing their accounts

- Perform other duties as assigned by the advisor

- Ability to adhere to rules and regulations as stated and required by advisor, Ameriprise Financial and regulatory agencies

29

Financial Paraplanner Resume Examples & Samples

- Work with home office to ensure accurate account setup and resolve issues

- Answer questions and provide readily available information to clients, if requested and as allowable, as it relates to servicing their accounts

- Maintain files and records in accordance with the records retention policy

- As necessary, prepare preliminary financial planning recommendations as well as initial product solutions for advisor review and use in client meetings

- Perform other allowable duties as assigned by the financial advisor(s) and associate financial advisor(s)

- Call clients to set up meetings or appointments

- Set up and maintain client management system

- Review and respond to emails as necessary

- Review work methods and procedures for possible quality improvements and efficiencies; implement them when appropriate

- Assign and delegate work and provide feedback, when appropriate, to other support staff

- Act as a technical resource to provide training and support

- Act as a back up to other staff

30

Paraplanner, nab Financial Planning Resume Examples & Samples

- Efficient and timely development of Statements of Advice (SOAs) that deliver optimal outcomes for clients and meet prescribed compliance and current quality standards

- Maintaining continual educational requirements

- Meeting service standards regarding the quality and level of plan production

- Effectively utilising financial planning software and modelling tools; and

- Participating in team activities and projects where relevant

31

Paraplanner, Melbourne Resume Examples & Samples

- Efficient and timely development of SOA's that

- Deliver optimal outcomes for the client

- Meet prescribed compliance and quality standards

- Researching products, strategies and technical issues to ensure knowledge is kept current

- Maintain continuing educational requirements

- Meeting service standards re quality and level of plan production

- Participation in team tasks and other projects as directed by the Team Leader

- Tertiary qualification in finance/financial planning, business or related discipline preferred

- Completed Diploma of Financial Services (or equivalent) as a minimum

- Completed Margin Lending Gap Training

- Must be RG146 compliant and eligible to hold a Letter of Authority

32

Senior Paraplanner Resume Examples & Samples

- Ensure all Data Gathered by the Administrators concerning the Client(s) Financial Portfolio is complete, accurate and up-to-date

- Fact Finds

- Attitude to Risk Profile

- Prepare general product Illustrations

- Existing Portfolio Analytics

- Recommendation Portfolio Analytics

- Utilise Pension Technical Specialist, as required, on Occupational Pension Transfers

- Produce and maintain Reports and MI Business Trackers for the management team

- Contribute to the designing and updating of Suitability Letter templates so as to comply with current FCA, Regulatory and Legislative requirements

- Issue compliant, accurate and timely Suitability Letters, as required within our compliance framework, to the Client

- Comply at all times with the requirements of the Financial Services and Markets Act 2000, and the IFA Principles and Code of Practice

- Ensure all Regulatory obligations are discharged fully during all engagements with the client

- Ensure TCF obligations are embraced and adhered to

- Considerable experience of working within a Paraplanning, or related role with extensive pensions knowledge

- G60 or AF3 qualifications

- Knowledge of occupational transfers

- Strong report writing and verbal /numerical skills

- Strong analytical and research skills

- Experience of Selectapension and O&M systems

33

Paraplanner Resume Examples & Samples

- The duties and responsibilities of this position are included but not limited to the list below*

- Develop portfolio solution recommendations that will fit client’s risk tolerance and time frame as well as develop appropriate product deliverables

- High level of client contact in person and via phone & email

- Provide clerical support to advisors

- 2+ years of industry experience

- Already have or be able to study and pass exams for federal and state licenses and registrations for securities, including Services 7, Series 66 and State life, accident and health insurance licenses

34

Ipac Paraplanner Resume Examples & Samples

- Have a minimum of 3 years paraplanning experience, familiarity with XPLAN or COIN or another financial planning software program and strong technical knowledge

- You will need a Diploma of Financial Services (DFS) and ideally be working towards completion of ADFS

- A solid team player, you will have an excellent telephone manner and a strong client service orientation that enables you to build strong relationships with the advisers we service

- A quick learner and a passion to get things right the first time, you will relish working effectively and efficiently to meet individual and team goals

- Candidates with experience in SMSF and gearing advice will be highly regarded

- The chance to gain exposure to a wide array of financial strategies

- Great opportunity to work for a leading wealth management organisation

- Challenging and diverse role within a supportive environment

35

Paraplanner Resume Examples & Samples

- Experience in a Paraplanning role

- Completed tertiary qualifications in Business, Banking & Finance or similar

- Completed Diploma of Financial Services (or equivalent) and RG 146 Compliant as a minimum

- Completed or may be studying for Advanced Diploma of Financial Services (or equivalent)

- Outstanding interpersonal skills and a drive to achieve targets

- Sound knowledge of social security, superannuation, retirement strategies, taxation and investment theory

36

Paraplanner Resume Examples & Samples

- Must have a very high level of accuracy and experience with technical writing

- Direct attention to detail and organization

- Effective Communication with clients and other advisors/staff

- Positive attitude and professionalism at all times

- Coachable and open to learning and growing

- Full readiness to be an active team player

- Polite and clear phone manner

- Ability to adhere to rules and regulations as stated and required by Advisor and FINRA

- Ability to support and provide guidance for compliance within the Advisor’s Practice

- Positive attitude and sincere willingness to constantly learn and grow

- To be a Paraplanner, you must be willing to or already have passed exams for federal and state licenses and registrations for securities - including

- Quality of Work: Accurate, neat, attentive to detail, consistent, takes time to do it right, thorough, high standards, follows procedures

- Dependability: Consistent attendance, punctuality, and reliability. Follows policy completely

- Communication: Adept at oral and written communication, shares information with peers and supervisors, handles internal and external communications

- Internal/External Relationships: Agreeable, constructive, flexible, helps without being asked, handles customers/vendors/outsiders, seeks and maintains good relationships, expedites orders and projects

- Judgment: Tactful, displays sensitivity, uses common sense, maintains confidentiality, makes sound decisions, sizes up situations, takes appropriate actions

- Organizational Abilities: Sets realistic priorities, organizes time, sets schedules, meets deadlines, completes projects on time, uses time well, does not waste time, ability to coordinate with others

- Volume of Work: Keeps up with workload, meets crash programs when necessary, steady, consistent, willing to put in extra effort

- Job Knowledge / Technical Skills: Knows what has to be done, seldom needs instruction, proficient in all technical aspects of job, knows how to run equipment, able to work independently, able to instruct, guides and trains others, understands safety/security procedures and maintains them

- Motivation: Genuine commitment to job, energetic, self-starting, shows initiative, commitment, positive attitude, enthusiasm, and high energy level

- Reaction to Stress: Can be depended upon when deadline pressures intensify, able to remain calm and effective despite irritation or changes in plans and policies, rarely loses temper, shows good frustration tolerance, able to handle irate customers/vendors

- Problem Solving: Troubleshoots, quick insight and able to learn, handles complex assignments, analytical, gets to the point quickly

- Creativity: Innovative, generates original solutions, develops new options, and suggests improvements, willing to try new concepts

- Decisiveness: Willingness to make decisions, makes appropriate decisions, asks questions when needed

- Hygiene: Clothing appropriate to work (IE: work clothes, uniform, etc.). Comes to work clean, no offensive odors, appears healthy and clear-eyed – not flushed or pale, alert, physically capable (IE: clear speech, awake)

37

Paraplanner Resume Examples & Samples

- Prepare for all client meetings by pulling relevant information from reports, creating virtual meeting folders, reviewing prior meeting documentation stored in OFM and updating client stored information in Contact Manager. In turn, use Contact Manager to create the Meeting Agenda to be used in the advisor/client appointments

- Submit and track client applications and paperwork to Home Office

- Interact with clients, peers and home office employees to solve problems, facilitate operations and solicit information as needed

- Coordinate and track Financial Planning payment activity to include invoicing, monitoring SPO arrangements and resolving related issues

- Oversee and manage the completion and submission of the planning deliverable as required by Home Office

- Project Manage various responsibilities such as Yearly Required Minimum Distribution transactions for associated clients

38

Paraplanner Resume Examples & Samples

- At least 2 years previous paraplanning experience

- Coin and/or Xplan experience

- Diploma of Financial Services (DFS)

- Completed ADFS or demonstrated success in continuing ADFS studies

- Experience with and good working knowledge of various tax structure will be highly regarded

39

Paraplanner Resume Examples & Samples

- 3-5 years relevant industry experience

- Good understanding of funds management, drivers of market performance and the financial planning process

- Ability to build strong relationships across the business and excellent communication skills

- Ideally working towards completing the National Certificate in Financial Services

40

Paraplanner Resume Examples & Samples

- Demonstrable experience in a Paraplanning role or wealth administration

- Completion of DFP 1-4 (RG146)

- Strong financial planning background and proven knowledge of strategies and technical competencies

- Experience in Statement of Advice preparation and understanding of advice strategies

- Sound verbal and written communication skills

- Competent user of a financial planning CRM software

- Collaborative, adaptable and hardworking attitude

- Analytical and ability to work under pressure

41

Senior Paraplanner Resume Examples & Samples

- Manage planning workflow

- Prepare reports to a high standard and within agreed timescales

- Provide information for annual reviews and identify areas not covered

- Build strong working relationships with clients, both face to face and remotely

- Undertake financial planning and product based research

42

Senior Paraplanner Resume Examples & Samples

- Preparing complex SoA’s across a wide range of financial strategies

- Peer reviewing SoA’s including dealing with technical queries and follow-up outstanding matters

- Maintaining a thorough technical knowledge of and the compliance with licensing and professional standards under which we operate

- Several years in a direct paraplanning role

- Ability to manage multiple tasks

43

Paraplanner Resume Examples & Samples

- Assist the team’s Wealth Planners in managing clients’ planning needs and solutions

- Be an additional point of contact at Cazenove Capital Management when the Wealth Planners are not available or busy and, therefore, to develop a relationship of trust with the clients

- Attend client meetings with the planner wherever possible to broaden understanding of the advisory process and to strengthen relationships with clients and keep detailed meeting notes of key issues discussed

- Responsibility for the timely drafting of client advisory letters to be signed off by the relevant authorised advisory personnel

- To maintain asset and income schedules for all advisory clients, including large family groups and individual clients and share these within the firm where required

- To assist the planners in assessing available options and solutions for clients

- Handle other administrative duties in a timely manner. This would include letters of new client take-on forms, preparation of advisory correspondence / annual reviews and assist in proposal preparation

- To react to all client related enquiries in a timely manner and maintain a record of responses

- Deal with insurance companies as required to obtain client policy information or new illustrations and product information

- Check that new business and client files are kept complaint and in line with Cazenove Capital Management’s documented procedures

- Deal with the WP support team and delegate administrative work as required

- Professional, organised and motivated

- Strong interpersonal and verbal/written communication skills

- Very presentable with client facing demeanour

- High level of numeracy

- Good understanding of Avelo 1st Software and The Exchange systems

- Good level in Microsoft Word, Excel and PowerPoint

- A keen interest and a good basic understanding of the Wealth Management and financial planning industry

- Familiarity with the fund management, professional advisory, IFA or life company industry

- Minimum 3 ‘A’ levels or equivalent

- Degree qualified or equivalent

- Financial Planning Certificate and Diploma or FSA approved Level 4 RDR compliant qualification

- Experience of working within the financial services sector, ideally for a wealth management firm or financial advisory practice with HNW client base

44

Paraplanner Resume Examples & Samples

- Preparation of compliant, comprehensive Statements of Advice (SoA's) for new and existing clients that range from simple to complex strategies, and which may include both investment and insurance advice

- Work in conjunction with the Financial Planners in the development of strategic advice for clients including wealth creation, tax effective investment strategies, superannuation, retirement planning, risk management and estate planning

- Build strong relationships with the Financial Planners and other members of a team

- Ensure that all client information is entered into the appropriate client management system accurately and that workflow and other relevant database information is kept up to date

- 1-2 years paraplanning experience (in a similar role) with a particular focus in strategy development

45

Senior Paraplanner Resume Examples & Samples

- Preparation of financial modelling utilising financial planning software (XPLAN)

- Assist Financial Planners with answering client queries and client review meeting preparation

- Paraplanning workflow management

- Provide technical support to the Financial Planners and remaining up to date on legislative and industry changes

- Adhere to Company policies and procedures, regulatory and legislative requirements

- Holistic Financial Planning strategy development

- High level of Australian financial planning technical knowledge including

- Successfully completed Advanced Diploma of Financial Planning (1-8) and looking to commence or have completed Certified Financial Planner (CFP) qualification

- 2-3 years paraplanning experience (in a similar role) with a particular focus in strategy development

46

Paraplanner Resume Examples & Samples

- Assisting the advisor with client data collection using our software and other office tools

- Communicating with clients and prospects in order to gather and input data as well as seeking out additional information needed to complete plans

- Preparing financial analyses for clients, including retirement analysis, estate-planning analysis, education-funding analysis, stock options analysis and risk management needs analysis

- All aspects of pre-client-meeting activities, such as preparation of meeting agendas, client paperwork, investment policy statements and asset allocations, as well as post-client-meeting tasks such as developing meeting notes, performing financial situation analyses and coordinating planning implementation with outside professionals if necessary

- Assist clients in maintaining their online client portals

- Continuously monitoring clients' financial situations with detail and accuracy

- Populating our CRM database (Salesforce) with client information and updates

- Assist clients with online training

- Bachelor’s Degree required (Finance, Economics, Business or related financial related discipline)

- Must have paraplanner designation or currently enrolled in paraplanner program or currently enrolled in CFP certification program

- Must have Series 65 or obtain within 6 months of hire

47

Licensed Paraplanner Resume Examples & Samples

- Execute and verify trades/ transactions under the direction of a Financial Advisor on our team

- Assist clients with money transfers in/out, Required Minimum Distribution’s and any other money related calls

- Provide general client service as required by business needs

- Ability to work with large teams

48

Paraplanner Resume Examples & Samples

- Financial data inputting and analysis

- Determining solutions to the various Financial Planning goals.Communicating Financial Planning recommendations made within Financial Plans to EFPS Regional team members

- Assisting EFPS Planners in providing Estate and financial planning services to qualified clients of Sun Life through direct engagement with qualified assigned advisors

- Providing personalized comprehensive Financial Plans and Special Reports to qualified clients via EFPS Regional team members and assigned CSF advisors

- Acting as a technical resource for advisors in support of providing advanced personalized comprehensive financial support to their customers

- The incumbent in this job has accountability for

- Contributing to CSF sales results by providing EFPS qualified clients with compelling holistic financial planning recommendations

- Provide estate and financial planning technical resources for advisors and Financial Centres where necessary and appropriate

- Assisting in delivering seminars/presentations on advanced planning topics

- Developing a current and thorough knowledge of estate and financial planning through research, attending industry related functions, etc

- 2 -3+ years in a Financial Planning or related role and working towards, or obtained one or more of the following accreditations

- CFP

- CLU

- CSC

- PFP

- LI-SC1

49

Paraplanner Resume Examples & Samples

- Track financial plan payments, delivery cycle and renewals

- Research and develop portfolio/robust product solution recommendations that will fit the client’s risk tolerance and time frame as well as develop appropriate product deliverables

- Trade in clients’ accounts as needed. Implement all investment changes as approved by clients

- Ensure all compliance requirements/requests are met

50

Paraplanner Resume Examples & Samples

- To act as primary point of contact for all technical enquiries taking account of changing legislative and regulatory requirements

- Liaising with providers, platforms, representatives and other relevant third parties and participate in case conferences with colleagues

- Assist with information gathering, liaison with clients, research, technical analysis and preparation of recommendations and documentation to help advisers deliver innovative and accurate financial planning solutions within agreed timescales

- Demonstrate and apply on a daily basis an in depth knowledge of relevant products

- Work alongside colleagues to ensure delivery of an exceptional client experience

- Assist in the preparation for client meetings as required

- Prepare agendas for client meetings and write up of meeting notes for any meetings attended

- Obtain quotation illustrations, prepare comparisons, valuations and other documentation and make arrangements ahead of client reviews and maturities

- Ensure all relevant documents, facts and client information are obtained and recorded and systems, processes and software are fully utilised where appropriate, including Lifestyle Planning and Cashflow Modelling

- Help to ensure all documents and report templates are up to date, accurate, technically correct, compliant and user friendly

- Review existing products, client portfolios, asset allocation and risk profiles and obtain and assess information and prepare analysis, illustrations and comparisons to show all relevant charges, performance, policy terms and other considerations to help facilitate comprehensive and compliant analysis and asset migration, as appropriate

- Work to ensure all files and records contain sufficient information and documentation to achieve a ‘Pass’ status for all SQA file reviews and compliance checks

- Planning, Organising and Delivering

- Personal impact and team effectiveness

- Client Service/Stakeholder Management - Practitioner to Advanced

- Knowledge of internal operational processes and systems - Advanced to Expert

- Company and Market knowledge - Practitioner

- Compliance and Operational Risk - Practitioner to Advanced

- Understanding of the FCA regulated requirements and environment

- Compliance and Operational Risk – Data management - Advanced - Expert

- Good standard of education

51

Paraplanner Resume Examples & Samples

- Discuss client objectives with the Adviser during debrief. Identify any shortfalls in client information and discuss with the Adviser

- Request and review all necessary information and undertake financial analysis to produce financial reports for discussion with the Adviser. Undertake research to identify suitable solutions to meet the client’s needs. Request and obtain information/comparisons for analysis by the Adviser. Consider current and future allocation of assets for investment strategy with regard to client risk profile

- Check all compliance paperwork and internal sign off documents are present

- Prepare draft recommendation reports to be discussed and signed off by the Adviser. Ensure any recommendations detailed in a report are in line with any internal guidance/procedures

- Request and obtain application forms and other associated paperwork

- Submit paperwork when advice taken up in accordance with Company procedures. Ensure all paperwork is in order

- Ensure appropriate data is accurately recorded on Company back-office system(s) and updated in line with Company procedures

- Undertake annual reviews, where appropriate

- On-going servicing of clients as and when required

- Understand, follow and demonstrate compliance with all relevant internal and external rules, regulations and procedures that apply to the conduct of the business. Follow principles and rules of the Financial Conduct Authority (FCA) and the internal requirements set out in the Compliance Manual, local and Group Compliance and Risk policies

- To ensure adherence to Department’s and Company procedures and Department’s Key Performance Indicators (KPIs)

52

Paraplanner Resume Examples & Samples

- Excellent written communication skills

- ADFP(FS) qualifications

- Results focused with an attention to detail

- Proficiency in using COIN, Word and excel

- Proven years of paraplanning experience

- SMSF accreditation is highly desirable

53

Chartered Paraplanner Resume Examples & Samples

- Relevant experience in investment and pensions (ideally DB schemes)

- CII qualified

- Great business acumen

54

Paraplanner Resume Examples & Samples

- Develop internal and external relationships to assist in providing an efficient service to clients and manage their expectations on work being undertaken, taking into account income being received and the agreed service levels to be provided

- Liaise with colleagues, other departments, clients and product providers to ensure that requirements of the business and agreed deadlines are met

- Working in a team to provide a first class administration service to both internal and external clients

- Apply the technical knowledge acquired from examinations and experience gained within the financial planning/wealth industry to produce and deliver high quality advice in a timely manner

- Work within FCA Regulations to provide in depth research and analysis according to client objectives

- Produce comprehensive, accurate and clear recommendation reports using a combination of standard paragraphs and free text

- Obtain illustrations, quotations and fund fact sheets

- Conduct research and analysis of fund data and DFM performance information

- Use of cash flow modelling ‘What if’ scenarios to determine most appropriate solutions for clients

- Participate in handover meetings with advisers and deal with follow up actions from the meeting

- Service existing clients profitably and in a manner which is compatible with an RDR business environment

- Collaborate with advisers, operations and technical teams, and manage their expectations taking into account the agreed SLAs

- Keep Consultants and line management updated with progress towards agreed deadlines, and communicate clearly in all directions on work-related matters

- Demonstrate teamwork and shared responsibility for colleagues’ workloads, to ensure that workload imbalances are managed effectively and do not impact negatively on client service

- Ensure work is completed accurately, to an exceptional standard of accuracy, and in line with processes and procedure. Demonstrate that we are willing to correct mistakes if the service is not up the required standard

- Contribute to the general development and continuous improvement of the team in particular processes and procedures

- Dealing with clients and colleagues in writing and on the telephone in a professional manner

- Working to specific time deadlines and service levels agreed with clients and line management

- Demonstrate commercial awareness and support income generators by prioritising work effectively in order to meet Wealth Management financial objectives

- Maintaining an awareness of service levels provided to the client and managing work load/costing in reflection of this. Logging time spent via time sheet management

- Assist with identifying where client profitability could be improved or new business opportunities for the Consultants to follow up

- Support the National Director within the remit of your role to deliver sustainable profit growth

- Providing information to internal sources with regards to client’s when requested to enable fees to be invoiced accurately and in a timely manner

- Prioritise and take proactive responsibility for own workload in accordance with Company procedures

- Task/diary Management using internal workflow management systems, ensure an audit trail of correspondence is evident for each task carried out

- Liaise with other departments, for example Advice Policy and Compliance, to ensure all work meets Company standards

- Ensure client data (Adviser Office/Virtual Cabinet) is clean, accurate, up to date, and fit for purpose

- Ensure our client records (AO/Virtual Cabinet) are organised and contain all relevant information according to processes and procedures

- Participate regularly in meetings, including highlighting issues and owning actions through to resolution

- Assist management with training and development of team members where required

- Undertake appropriate CPD /KPI’s as agreed during Performance Reviews to maintain and enhance knowledge and skills

- Ensure all work carried out and all communications with clients are in accordance with the FCA guidelines, compliance policies/procedures and the Advice Policy, and that anti-money laundering procedures are followed

- Carry out duties within our internal policies and procedures in accordance with applicable laws, rules, regulation, good governance and Gallagher’s shared values, including putting clients at the heart of our business

- Additional accountability for Pension Transfer Specialists who will have an FCA Approved Persons CF30 controlled function: Carry out your role in accordance with the FCA’s Statements of Principle and Code of Practice for Approved Persons and remain mindful at all times of the FCA’s Principles for Business

- High level of technical Wealth Management knowledge will be required, including Pensions, Investment and Protection, IHT and Tax Efficient Investments. Previous experience with product providers, wrap platforms and DFMs is desirable

- Knowledge of research tools and software

- Good working knowledge of FCA regulatory requirements

- Keep up to date with industry changes and regulation via Compliance bulletins, technical updates

- Proficiency in complex report writing

- IT literate – Microsoft Office (Excel, Word) and relevant internal systems/databases

- Familiar with Adviser Office administration systems and Virtual Cabinet

- Ensures that individually and as a firm we “Treat Customers Fairly”

- Awareness of the regulatory requirements in respect of ‘advised’ and ‘non-advised’ sales, and in particular evidencing the standards and knowledge required in respect of giving advice and making recommendations to customers

- Demonstrable paraplanning experience within the Wealth Management sector, to targeted service standards and procedures

- Strong verbal and written communication skills at all levels, both internally and externally

- High level of accuracy and attention to detail in all areas of work

- Excellent organisation skills, with ability to work to tight deadlines and manage multiple tasks

55

Paraplanner Resume Examples & Samples

- B.A. or B.S. in Finance or Economics preferred, or relevant

- 1+ years (ideally 2+) in relevant environment (wealth management/investment management/financial services/wealth operations)

- Excellent communication skills - written and verbal

- Experience with MoneyGuide Pro strongly preferred

- Eager to learn, Friendly, and professional positive attitude

56

Associate Wealth Specialist / Paraplanner Resume Examples & Samples

- Ensure the personal advice documentation is provided at a very high standard and in the client’s best interests

- Achieve SOA, ROA and other advice document KPIs

- Ensure advisory standards, process and controls are adhered to

- Work closely with Wealth Specialist(Financial Planners) and Product Managers to achieve business goals

- Ensure strong technical knowledge on investments, superannuation, insurance and financial planning is kept up to date

- Ownership of advice execution of financial plans via Product Platforms

- Assist Wealth Specialist in maintaining their ongoing personal advice clients

- Work closely with Head of Advice in process improvement and technology enhancements

- Assist the team on ad-hoc team administration

- LI-W

- Financial advisory experience

- Minimum 3 years experience as Paraplanner

- Strong Experience in COIN or Xplan

- Good understanding of personal advice process, advisory standards and advice documentation requirements

- Good understanding of financial planning strategies including retirement planning, wealth creation, superannuation strategies and centrelink

- Good working knowledge of investments including portfolio construction, product selection covering managed funds, wrap accounts, superannuation, pensions, annuities and structured products

- Good working knowledge of life insurance including the ability to conduct insurance needs analysis, matching appropriate insurance products to client’s needs and follow up with the underwriting process

- Proven stakeholder and relationship management skills

- Foreign language skills are favourably considered

57

Paraplanner, Wealth Resume Examples & Samples

- Prior experience in Paraplanning preferred but not necessary

- Strong ability to write detailed technical proposals for presentation to potentially unsophisticated recipients

- Ability to adapt quickly, work under pressure and manage multiple activities in accordance with delivery requirements and timelines

- Ability to discuss, debate, and provide direction to assist frontline staff’s development of financial planning disciplines

- Industry qualifications (Certificate in Financial Planning-CFP) desired

58

Senior Paraplanner Resume Examples & Samples

- Tertiary/ post graduate qualifications in business/finance. Completion of Advanced Diploma of Financial Services or Advanced Diploma of Financial Planning

- Strong financial planning background and proven knowledge of strategies and technical competencies in a Paraplanning role

- Experience in Statement of Account (SOA) preparation particularly in relation to complex strategies

- Experience utilising multiple entities including Self-Managed Super Fund (SMSF), Trust and Corporate Structures

- Analytical, work under pressure and manage multiple activities in accordance with business requirements and timeline

59

Paraplanner Resume Examples & Samples

- To generate income for the business through the delivery of high quality paraplanning service. To undertake all tasks as directed by the Head of Fidelity’s Retirement Service and/or adviser team to assist in this goal

- To liaise with the adviser and support teams to reduce duplication of effort and ensure that all advised clients are well managed in a timely fashion during their journey through Fidelity’s Retirement Service

- To identify where improvements in service can be made and to manage the paraplanning workload, delegating tasks as appropriate and ensuring all procedures are documented and kept up-to-date

- In maintaining contact with product providers, to refuse all offers of hospitality, however small, and to ensure that the best interests of the client are always protected

- To operate within FCA and other regulatory rules at all times

- To analyse ceding pension scheme information and quotations for a client and prepare draft suitability reports for the adviser team

- When placing an annuity on behalf of a client, to ensure that the best possible rate is always obtained

- To operate within guidelines and procedures laid down by the company at all times to ensure customers are treated fairly

- To act in a professional and customer focused manner in accordance with the company values at all times

- To ensure all customer files are kept up-to-date at all times

- To support and uphold the Fidelity vision and values

- To undertake all reasonable tasks and duties as directed by the Head of Fidelity’s Retirement Service

60

Financial Planning Assistant / Paraplanner Resume Examples & Samples

- Series 7, Series 66, and California life, accident and health insurance licenses

- Bachelor’s degree or higher

- 1 year of experience in Financial planning office

- Please provide your resume and cover letter indicating why you would be a great hire

- Certified Financial Planning designation

61

Paraplanner Resume Examples & Samples

- Bachelor’s or Master’s degree required in Financial Planning or related field

- Creative problem solving, critical thinking and research skills

- Highly motivated and takes initiative for professional growth and development

- Outstanding time, organization and project management skills

- Ability to take direction, and exercise sound judgment, tact and diplomacy

- Ability to travel to client locations which may include occasional overnight stays (travel expectations vary by department and office location; talk to your local recruiter regarding specifics)

- Ability to work overtime as needed

- Must be legally authorized to work in the United States on a full-time basis upon hire. Moss Adams will not provide sponsorship for this position for candidates requiring sponsorship for employment visa status now or in the future (e.g., H-1B status)

62

Financial Planning Assistant / Paraplanner Resume Examples & Samples

- Undergraduate degree in Financial Planning and/or 1+ years’ experience in a financial services firm

- Coachable and flexible

- Exceptional attention to detail

- Excellent planning, organizational and prioritization skills

- Effective communication skills with clients, advisors and other staff

- Positive attitude and sincere willingness to learn and grow

- Goal-oriented and success-driven

- Already have or be willing to study for and pass exams for Series 7, Series 66, state insurance licenses and the Certified Financial Planning designation

63

Collaborative Paraplanner Resume Examples & Samples

- Advanced Diploma in Financial Planning (ADFP) or higher

- Strong paraplanning background and proven knowledge of strategies and technical skills

- Ability to work under pressure and to demonstrate up-to-date knowledge

- Experience using Coin (or similar) Financial Planning software as well as outstanding written and verbal communication skills

64

Paraplanner Resume Examples & Samples

- Preparing complex SoA’s across a wide range of financial strategies (Super, Risk, SMSF, Trusts and Defined Benefits)

- Mentoring and coaching junior paraplanners

- Performing detailed financial modelling and scenario analysis using Xplan

- A tertiary degree in a Finance discipline and have a DFP/DFS or RG146 equivalent qualification

- Experience using Xplan (including Xtools+) is preferred but not essential

65

Paraplanner Wealth Management Advice Resume Examples & Samples

- Develop strategically accurate Statements of Advice

- Participate in process improvements within the business

- Provide technical support to advisers and peers

- Engage in continuous learning and knowledge sharing with your team

66

Paraplanner Resume Examples & Samples

- Preparation of compliant, comprehensive Statements of Advice (SoA's) for new and existing clients that range from simple to complex strategies, and which may also include investment and insurance advice

- Strong understanding of superannuation including SMSF’s

- High level of knowledge on personal insurance

- Strong understanding of investment structures and entities

- High level of knowledge in Australian tax law

- High level of knowledge in estate planning

- Financial planning advice process

- Excellent communication (both written and verbal) skills

- Ability to work under pressure and to tight timeframes

- Ability to work autonomously and as part of a small team

- Ability to build rapport with people (in local office, across branches nationwide & different organisations)

- Strong analytical and organisational skills

- Passion for advice quality, accuracy and timeliness

- Minimum 2 years paraplanning experience (in a similar role) with a particular focus on strategy development

67

Wealth Planning Paraplanner Resume Examples & Samples

- Client focused solutions orientation

- Ability to take a project from inception to successful completion

- Superior collaboration skills

- License 7 and 66 required for further advancement

68

Financial Services Paraplanner Resume Examples & Samples

- 3 years of years’ experience with Securities and/or Insurance products

- FINRA Series 7 and Series 63 securities registrations desired. If not possessed, to be pursued on an agreed upon schedule

- Paraplanner certification desired. If not possessed, to be pursued on an agreed upon schedule

- Active Maine Life and Health License

- LI-AR

69

Paraplanner Resume Examples & Samples

- Write and review recommendation reports for individual clients based on the factfind provided by a financial planning consultant

- Oversee the ongoing review and servicing needs of our individual clients

- Ensure that the advice provided to individual clients is the best advice

- Ensure that current insurance provider terms and fund information is up to date

- Conduct research into investment, pension, ARF and protection products as required for the Product Review Group

- Manage report templates for our individual client recommendations

- Manage client responses in a timely manner

- Maintain a strong relationship with consultants, clients and team members

- Assist where required in the preparation, project management and delivery of member advice projects

- Develop intellectual capital for advisers on hot topics

- QFA Qualification essential

- Specialist Investment Adviser/Certified Financial Planner, CFP©/Chartered Financial Analyst are desirable but not essential